Apologies in advance as I employ another sheep analogy. In my defence, opportunities to use it abound and this one actually includes one. Also, it’s really more of a confession and self-deprecation seemed like the most charitable way of making my point. Walk with me…

My spouse and I are known to frequent fundraisers. That is, back when they were still “allowed”. They’re a great way to see friends, share some laughs and help worthy causes. The silent auction is always my favorite. In fact, much of the art that graces our home is the result of our successful outbidding of other attendees – sadly, this includes some of our dearest friends. Even sadder – it’s become a badge of honor. Years ago, we found ourselves bidding on a small photograph. It was black and white and focused on a child’s hand gripping the fluffy wool of a lamb. I honestly can’t recall what inspired me as it quickly became a case of what was I thinking? Whatever whimsy captivated my imagination that night had dissipated by morning. In other words, it looked more creepy than cutesy. That’s not the worst part though. Not only did we outbid the other attendees, we outbid ourselves or, rather I did. I had somehow managed to double down on that last bid which, again, was my own! You know, to really send a message about just how much I wanted this – but, alas hubris can have very sharp teeth. There was nothing blind about this bidding. My ridiculousness was on full display for all the world to see. The same thing has been going on in Toronto Real Estate for years and years. In those cases, however, the winners have no idea whether they’ve actually been bidding against themselves, let alone by how much. That night I “won” a silly photo of some lamb and my little gaffe earned me every bit of ribbing and chortling from friends and strangers alike. Buyers who emerge successful in blind bidding wars in real estate can at least say they had no choice and were simply adhering to the rules of engagement. Let’s talk about that. The only rules according to REBBA (the Real Estate and Business Brokers Act – which governs the industry here in Ontario), dictate that realtors are required to disclose the number of offers registered but are forbidden from revealing the contents of any other offer or offers. Anything else coming from the various industry associations and local real estate boards is called “guidance”. We heard that word a lot last year as the pandemic was unfolding and real estate was deemed an essential service. How that service was actually supposed to be delivered was anyone’s guess, so there was a lot of confusion and frustration. That’s a whole other blog post though so I’ll save it for later. Aside from these two rules and the vagueness from everyone else, the actual process of managing multiple offers on a property is pretty much up for grabs (and don’t get me started on everyone’s favorite topic called multiple representation or, as it’s affectionately known: double ending – that’s a trilogy in and of itself). And that’s how we’ve ended up with the ridiculousness called blind bidding. No one in their right mind would intentionally engage in this. Even my own example above was accidental. Had I actually noticed I was bidding against myself, I would have made a different choice. So, why is everyone standing by acting helpless? Ask any Realtor and they’ll tell you “Oh, I’m just representing my Seller!” or “Oh, I’m forbidden from disclosing anything – your Buyer needs to waive their conditions and offer more money if they really want the place!” Pure ridiculousness. It’s not that complicated and we don’t need to overthink it or become paralyzed with fear because we don’t fully understand the rules. I’m just spit balling here, but let’s imagine the following:

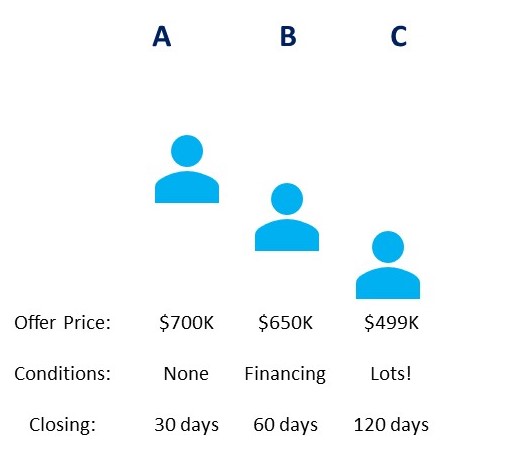

A Property is listed at $499K (a low ball price, naturally) with offers “graciously reviewed” on a given date and time. Offer day rolls around and let’s assume the Seller receives 3 offers.

Buyer A offers $700K, no conditions and a quick close.

Buyer B offers $650K, conditional on financing, and a slightly longer closing date.

Buyer C (and, trust me, there is ALWAYS one like this) is $499K, conditional on financing, home inspection, eligibility to obtain insurance – AND clear visibility of three consecutive blood moons between now and closing.

What to do??

How about this:

The first offer is clearly the strongest. So, we don’t really need to do anything. In fact, doing anything about it – like asking them to bid against themselves – would clearly be ridiculous and should actually be a criminal offence.

The second offer is good but not as strong.

The third one is almost laughable but it’s still an offer, the realtor went to the trouble of arranging a showing and the Buyer did sign it in good faith. And, since we don’t know how all this will play out, we should treat it with the same respect and appreciation as any other offer. Believe it or not, it may in fact turn out to be the best offer we have. Stranger things have happened.

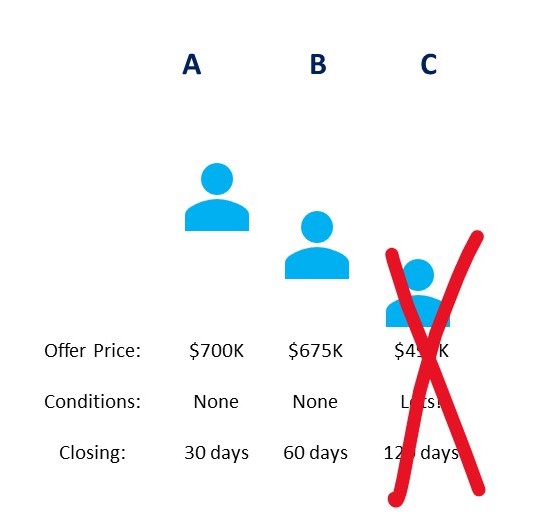

So why don’t we go back to Buyer A and let them know that, so far, they are in the strongest position and can just sit tight. Then we go back to the other two buyers, tell them how they rank in terms of price and overall strength. Note: we are not revealing the contents of the other offers, we are simply ranking them and telling the weaker players where they stand more or less (Buyer B is 2nd, Buyer C is 3rd etc.). Then, we invite them (notice I said invite, not request or demand) to improve their offer – ONCE. It’s up to them whether and how they choose to do so – improving price, removing a condition or conditions. Or they can simply stay put or pull out. Here’s what it might look like if Buyer B improves their offer while Buyer C steps away:

Buyer B has improved their offer by increasing their price and removing their financing condition. Buyer C pulls out. Buyer B still hasn’t surpassed Buyer A though, so Buyer A’s offer is likely still accepted by the Seller.

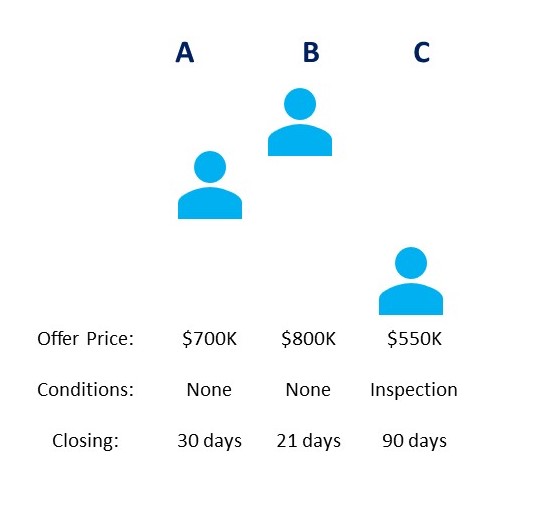

But what if Buyer B Surpasses Buyer A? In the illustration below, Buyer B has increased their price substantially, removed their financing condition and shortened their closing date. Buyer C has also increased their price slightly, and removed all but their inspection condition and shortened their closing to 90 days. It might look something like this:

Now Buyer A has ONE chance to improve their offer. If they surpass Buyer B, their offer may get accepted. If they do not, Seller likely accepts the offer from Buyer B.

Of course, it’s not always about price and Sellers are free to work with any offer they choose, but assuming all things equal this process might be the fairest and most transparent way of treating all parties without running afoul of the Act. Plus, I’m willing to wager that at the end of it, this Seller will still be entertaining the same number of offers they started with because the Buyers all feel like they have at least some semblance of transparency. It’s never talked about, but while we are required to disclose the number of offers registered on a property, there is nothing guaranteeing that all buyers are kept apprised of how many players are still in the game by the time all is said and done. This is all part of the blindness factor. I’m betting that all three buyers above will stay in the game right to the end. Because at least they’ve been given some sign of where they stand. Also, I think we can all agree the current process is 100% contributing to unprecedented price inflation. I mean, when buyers are bidding against themselves, I think it’s fair to say that final prices are probably ringing in a lot higher than they otherwise would have. And if you think that Buyers are the only casualties in all of this, talk to Sellers who have had Buyers default because the eye watering price they offered failed to appraise. Nobody wins in that scenario. 2017 was full of those stories. I guess history will show us how the current hysteria stacks up.

So, what’s the cure for blind bidding? I’ve offered one humble suggestion above as a working copy. I’m pretty sure there are others. But surely the regulator and various lobbying associations along with all the countless local boards can bash their heads together to come up with something. Then, instead of handing us guidance, they can actually demonstrate leadership. Realtors need it. And consumers deserve it.

Next up: Pick a number: What’s Really Behind Low Ball List Prices?

Great thought process and excellent suggestions. (And entertaining to boot!).

LikeLike